UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULESchedule 14A INFORMATIONInformation

PROXY STATEMENT PURSUANT TO SECTIONProxy Statement Pursuant to Section 14(a)

OF THE SECURITIES EXCHANGE ACT OF of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to |

FUTURE FINTECH GROUP INC.

(Name of Registrant as Specified In Its Charter)

| Future FinTech Group Inc. |

| (Exact name of registrant as specified in its charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| N/A |

| (Name of person(s) filing proxy statement, if other than the registrant) |

Payment of Filing Fee (Check(check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Future FinTech Group Inc.

23F, China Development Bank Tower

No. 2, Gaoxin 1st Road

Xi’an, Shaanxi, China 710075

LETTER FROM THE CHIEF EXECUTIVE OFFICER

Dear Shareholder:

You are cordially invited to attend the 20182019 Annual Meeting of Shareholders of Future FinTech Group Inc., a Florida corporation (the “Company” or “Future FinTech”), which will be held at our principal executive offices, located at 23F, China Development Bank Tower, No. 2,No.2, Gaoxin 1st Road, Xi’an, Shaanxi, China, on Thursday,Friday, December 6, 2018,2019 at 10:00 A.M., local time.

The Notice of Annual Meeting of Shareholders and Proxy Statement describedescribes the formal business to be transacted at the annual meeting. Our directors and officers will be present to respond to appropriate questions from shareholders. A shareholder must complete the attached proxy card or be present in person to vote at the meeting.

Whether or not you plan to attend the meeting, please vote as soon as possible. You can vote by returning the proxy card in the enclosed postage-prepaid envelope. This will ensure that your shares will be represented and voted at the meeting, even if you do not attend. If you attend the meeting, you may revoke your proxy and personally cast your vote. Attendance at the meeting does not of itself revoke your proxy.

| /s/ Yongke Xue | |

| Yongke Xue | |

| Chief Executive Officer | |

| October 21, 2019 | |

| Xi’an, China |

FUTURE FINTECH GROUP INC.

23F, China Development Bank Tower,

No. 2 Gaoxin 1st Road

Xi’an, Shaanxi, China 710075

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held Thursday,Friday, December 6, 20182019

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Future FinTech Group Inc., a Florida corporation (the “Company” or “Future FinTech”), will be held at our principal executive offices, located at 23F, China Development Bank Tower, No. 2,No.2, Gaoxin 1st Road, Xi’an, Shaanxi, China, on Thursday,Friday, December 6, 2018,2019 at 10:00 A.M., local time, for the following purposes, as set forth in the attached Proxy Statement:

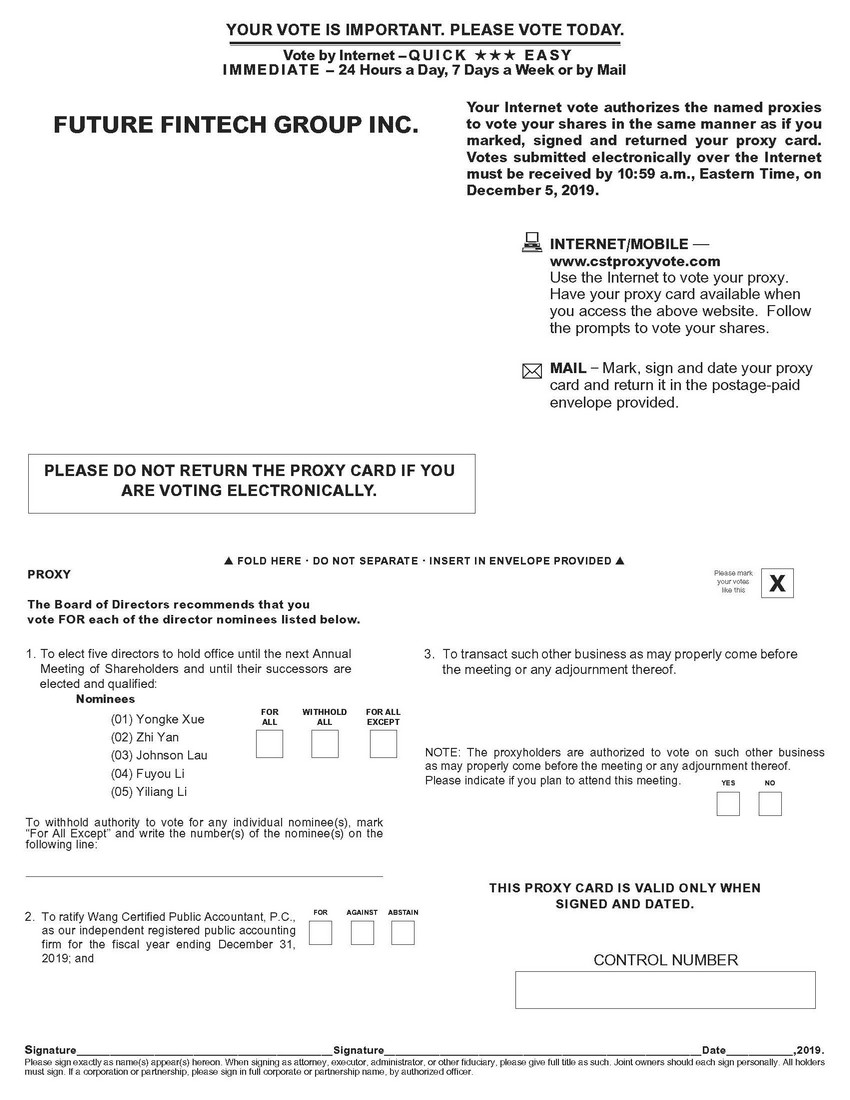

| (1) | To elect five directors to hold office until the next Annual Meeting of Shareholders and until their successors are elected and qualified; |

| (2) | To ratify |

| (3) |

| To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors of the Company (the “Board of Directors” or the “Board”) and the Company’s management has fixed the close of business on October 15, 201810, 2019 as the record date for determining the shareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment and postponements thereof (the “Record Date”).

After careful consideration, the Board of Directors recommends a vote IN FAVOR OF the nominees for director named in the accompanying proxy statement, and a vote IN FAVOR OF the ratification of the Audit Committee’s selection of theWang Certified Public Accountant, P.C., as our independent registered public accounting firm and a vote IN FAVOR OFfor the compensation of our named executive officers.fiscal year ending December 31, 2019.

Shareholders are cordially invited to attend the Annual Meeting in person. Whether you plan to attend the Annual Meeting or not, please complete, sign and date the enclosed Proxy Card and return it without delay in the enclosed postage-prepaid envelope. If you do attend the Annual Meeting, you may withdraw your Proxyproxy and vote personally on each matter brought before the meeting.YOUR VOTE IS VERY IMPORTANT.

By Order of the Board of Directors

| /s/Yongke Xue | |

Yongke Xue | |

| Chief Executive Officer | |

| October 21, 2019 | |

| Xi’an, China |

IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO MARK, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE-PREPAID RETURN ENVELOPE. SIGNING AND RETURNING A PROXY WILL NOT PREVENT YOU FROM VOTING IN PERSON AT THE MEETING.

THANK YOU FOR ACTING PROMPTLY

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held Thursday,Friday, December 6, 2018.2019. This Proxy Statement and our 20172018 Annual Report to Shareholders are available at http://www.ftft.top, which does not have “cookies” that identify visitors to the site.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS OF

FUTURE FINTECH GROUP INC.

To be Held on Thursday,Friday, December 6, 20182019

The Board of Directors of Future FinTech Group Inc., a Florida corporation (“Future FinTech” or the “Company”), is soliciting proxies for the Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held at our principal executive offices, located at 23F, China Development Bank Tower, No. 2, Gaoxin 1st Road, Xi’an, Shaanxi, China, on Thursday,Friday, December 6, 2018,2019, at 10:00 A.M., local time, and at any adjournments thereof. You are receiving a proxy statement because you own shares of the Company’s common stock that entitle you to vote at the Annual Meeting. By use of a proxy, you can vote whether or not you attend the Annual Meeting. The proxy statement describes the matters we would like you to vote on and provides information on those matters so you can make an informed decision.

PurposesTHE 2019 ANNUAL MEETING

Date, Time and Place of the Annual Meeting

The Annual Meeting will be held at 10:00 a.m., local time, on Friday, December 6, 2019, at the Company’s principal executive offices at 23F, China Development Bank Tower, No.2, Gaoxin 1st Road, Xi’an, Shaanxi, China, 710075.

The purpose of

Matters to be Voted Upon at the Annual Meeting

At the Annual Meeting, Future FinTech is to: (i) electasking its shareholders as directorsof the five nominees named in this proxy statement; (ii) ratify the Audit Committee’s selectionrecord date of independent registered public accounting firm; (iii) approve the compensation of our named executive officers in a non-binding, advisory vote;October 10, 2019 (the “Record Date”) to consider and (iv) conduct such other business as may properly come before the Annual Meeting. This Proxy Statement and the enclosed proxy card are intended to be mailed to shareholders on or about October 26, 2018.vote upon proposals:

| (1) | To elect five directors to hold office until the next Annual Meeting of Shareholders and until their successors are elected and qualified; |

| (2) | To ratify the Audit Committee’s selection of the independent registered public accounting firm for the fiscal year ending December 31, 2019; and |

| (3) | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Record Date and Voting SecuritiesDate; Shares Entitled to Vote

The BoardShareholders will be entitled to vote or direct votes to be cast at the Annual Meeting if they owned shares of Directors fixedFuture FinTech common stock on the Record Date. Shareholders will have one vote for each share of Future FinTech common stock owned at the close of business on October 15, 2018 (the “Record Date”) as the record date for shareholders entitledRecord Date. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to notice of andensure that votes related to vote at the Annual Meeting. As of that date,shares you beneficially own are properly counted. On the Record Date, there were 26,017,08332,317,083 shares of the Company’sFuture FinTech common stock (the “Common Stock”) outstanding and entitled to vote, the holders of which are entitled to one vote per share.outstanding.

Quorum

A quorum is the minimum number of shares required to hold a meeting. A majority of the shares of our common stock issued and outstanding and entitled to vote must be represented in person or by proxy at the meeting to establish a quorum. Both abstentions and broker non-votes are counted as present for determining the presence of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the matter on which the broker has not voted. Thus, broker non-votes will not affect the outcome of any of the matters to be voted on at the Annual Meeting. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power to vote such shares.

1

Voting Generally

Holders of record of shares of the Company’s Common Stock as of the Record Date are entitled to one vote per share on each matter to be considered and voted upon at the Annual Meeting. As of the Record Date, there were 26,017,08332,317,083 shares of Common Stock issued, outstanding and entitled to be voted, which were held by approximately 79 holders of record.

Our Second Amended and Restated Articles of Incorporation state that there is no cumulative voting in the election of directors. The affirmative vote of the holders of shares of Common Stock representing a plurality of the votes cast at the Annual Meeting at which a quorum is present is required for the election of the directors listed below. Abstentions and non-votes will be counted for purposes of determining the presence of a quorum, but will not be counted as a vote for the election as a director of any nominee.

Votes cast in person or by proxy at the Annual Meeting will be tabulated at the Annual Meeting. All valid, unrevoked proxies will be voted as directed. In the absence of instructions to the contrary, properly executed proxies will be voted (i) for the election of each of the nominees for director set forth herein and (ii) for the ratification of Wang Certified Public Accountant, P.C., as our independent registered public accounting firm; and (iii)firm for the approval of the compensation of our named executive officers in a non-binding, advisory vote.

fiscal year ending December 31, 2019.

If any matters other than those addressed on the proxy card are properly presented for action at the Annual Meeting, the persons named in the proxy card will have the discretion to vote on those matters in their best judgment, unless authorization is withheld.

Many of our shareholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own names. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record. If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer, you are considered the shareholder of record with respect to those shares. As a shareholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting. As the shareholder of record, you may vote in person at the Annual Meeting or vote by proxy using the accompanying proxy card. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

By Mail — shareholders must request a paper copy of the proxy materials to receive a proxy card and follow the instructions given for mailing. A paper copy of the proxy materials may be obtained by logging onto www.proxyvote.com and following the instructions given. To vote using the proxy card, simply print the proxy card, complete, sign and date it and return it promptly to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. In the alternative, the proxy card can be mailed directly to the Company: Corporate Secretary at 23F, China Development Bank Tower, No. 2, Gaoxin 1st Road, Xi’an, Shaanxi, China, 710075.

Online – shareholders may submit a proxy online using the website listed on the proxy card. Please have your proxy card in hand when you log onto the website. Online voting facilities will close and no longer be available on the date and time specified on the proxy card.

In Person — shareholders may vote in person at the Annual Meeting. To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. The Board recommends that you vote using one of the other voting methods, given that it is not practical for most stockholders to attend the Annual Meeting.

Please note that the notice letter you received directing you to the website at which the proxy materials are available is not the proxy card and should not be used to submit your vote.

If you do not return a signed proxy card, vote online or attend the meeting and vote in person, your shares will not be voted. Shares of our common stock represented by properly executed proxies that are received by us and are not revoked will be voted at the Annual Meeting in accordance with the instructions contained therein. If you return a signed and dated proxy card and instructions are not given, such proxies will be voted FORthe election of each nominee for director named herein, andFOR ratification of the selection of Wang Certified Public Accountant, P.C., as our independent registered public accounting firm, andFORthe proposal to approve, on a non-binding, advisory basis, the compensation of our named executive officers set forth in this proxy statement.firm. In addition, we reserve the right to exercise discretionary authority to vote proxies, in the manner determined by us, in our sole discretion, on any matters brought before the Annual Meeting for which we did not receive adequate notice under the proxy rules promulgated by the Securities and Exchange Commission (“SEC”).

Beneficial Holder. If your shares are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of the shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee who is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the meeting. Your broker or nominee has enclosed a proxy card for your use.

Required Vote

The nominees for election as directors at the Annual Meeting will be elected by a plurality of the votes cast at the meeting. This means that the director nominee with the most votes for a particular slot is elected for that slot. Votes withheld from one or more director nominees will have no effect on the election of any director from whom votes are withheld. The approval of each of the other proposals require the affirmative vote of a majority of the shares represented at the meeting and entitled to vote on that proposal.

If you are a beneficial owner and do not provide the shareholder of record with voting instructions, your shares may constitute “broker non-votes.” A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power and has not received instructions from the beneficial owner.

Under applicable regulations, if a broker holds shares on your behalf, and you do not instruct your broker how to vote those shares on a matter considered “routine,” the broker may generally vote your shares for you. A “broker non-vote” occurs when a broker has not received voting instructions from you on a “non-routine” matter, in which case the broker does not have authority to vote your shares with respect to such matter. Rules that govern how brokers vote your shares have recently changed. Unless you provide voting instructions to a broker holding shares on your behalf, your broker may no longer use discretionary authority to vote your shares on any of the matters to be considered at the Annual Meeting other than the ratification of our independent registered public accounting firm. Please vote your proxy so your vote can be counted.

Unless otherwise required by the Company’s Second Amended and Restated Articles of Incorporation, as amended, Bylaws, the Florida Business Corporation Act, or by other applicable law, any other proposal that is properly brought before the Annual Meeting will require approval by the affirmative vote of a majority of all votes cast at the Annual Meeting. With respect to any such proposal, neither abstentions nor broker non-votes will be counted as votes cast for purposes of determining whether the proposal has received sufficient votes for approval.

Directors and executive officers of the Company (excluding Mr. Zeyao Xue, the son of our Chairman and Chief Executive Officer) beneficially hold approximately 1,671,9551,721,955 shares of Company Common Stock, or 6.4%5.33% of all the votes entitled to be cast at the Annual Meeting. Mr. Zeyao Xue owns 13,084,114 shares of Company Common Stock or 40.49% of all the votes entitled to be cast at the Annual Meeting.

Deadline for Voting by Proxy

In order to be counted, votes cast by proxy must be received prior to the Annual Meeting.

3

Revocability of Proxies

Shareholders are requested to date, sign and return the enclosed proxy card to make certain their shares will be voted at the Annual Meeting. Any proxy given may be revoked by the shareholder at any time before it is voted by delivering written notice of revocation to the Secretary of the Company, by filing with the Secretary of the Company a proxy bearing a later date, or by attending the Annual Meeting and voting in person. All proxies properly executed and returned will be voted in accordance with the instructions specified thereon.

Householding

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy materials with respect to two or more shareholders sharing the same address by delivering a single set of proxy materials. This process, which is commonly referred to as “householding,” potentially results in extra convenience for shareholders and cost savings for companies. The Company has adopted the SEC-approved “householding” procedure.

Upon written or oral request, the Company will deliver promptly a separate copy of the Notice of Annual Meeting of Shareholders to any shareholder at a shared address to which the Company delivered a single copy of any of these documents. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate set of proxy materials, you may:

| ● | Send a written request to the Company’s Corporate Secretary at 23F, China Development Bank Tower, No. 2, Gaoxin 1st Road, Xi’an, Shaanxi, China, 710075, or call 86-29-81878277 if you are a shareholder of record; or |

| ● | Notify your broker, if you hold your common shares under street name. |

If you are receiving more than one copy of the proxy materials at a single address and would like to participate in householding, please contact the Company using the mailing address and phone number above. Shareholders who hold shares in street name may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding.

Future FinTech Information

Our principal executive offices are located at 23F, China Development Bank Tower, No. 2, Gaoxin 1st Road, Xi’an, Shaanxi, China, 710075. The telephone number of our principal offices is 86-29-81878277.

PROPOSAL 1 – ELECTION OF BOARD OF DIRECTORS

Directors

Based on the Company’s nominations process, a majority of the independent members of the Board shall recommend to the Board for nomination by the Board such candidates as said majority of the independent directors, in the exercise of their judgment, have found to be well qualified and willing and available to serve. A majority of our independent directors of the Board has recommended and the Board has nominated the persons listed below for election to the Board at the Annual Meeting, to hold office until the next Annual Meeting and until their respective successors are elected and qualified. It is not contemplated that any of the nominees will be unable or unwilling to serve as a director, but, if that should occur, the persons designated as proxies will vote in accordance with their best judgment. In no event will proxies be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

All shares represented by valid proxies, and not revoked before they are exercised, will be voted in the manner specified therein. If a valid proxy is submitted but no vote is specified, the Proxy will be voted FOR the election of each of the five nominees for election as directors. Please note that your broker will not be permitted to vote on your behalf on the election of directors unless you provide specific instructions by completing and returning the voting instruction form. For your vote to be counted, you will need to communicate your voting decisions to your broker or other nominee before the date of the Annual Meeting or obtain a legal proxy to vote your shares at the meeting. Although all nominees are expected to serve if elected, if any nominee is unable to serve, then the persons designated as proxies will vote for the remaining nominees and for such replacements, if any, as may be nominated by our Board, who currently serves the functions of a nominating committee as the Board does not have a standing nominating committee. Proxies cannot be voted for a greater number of persons than the number of nominees specified herein (five persons). Cumulative voting is not permitted.

The affirmative vote of the holders of shares of Common Stock representing a plurality of the votes cast at the Meeting at which a quorum is present is required for the election of the directors listed below.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL FIVE NOMINEES LISTED BELOW.

The following sets forth the information regarding our director nominees as of October 11, 2018,9, 2019, including the names of each of the five nominees for election as a director, such person’s position, age, the year such person became a director of the Company, and additional biographical data.

| Name of Current Directors | Age | |||||

| Yongke Xue (1) | Chairman | |||||

| Zhi Yan | Director | |||||

| Johnson Lau | Independent Director | |||||

| Fuyou Li (5)(3) | Independent Director | |||||

| Yiliang Li | 55 | Independent Director | ||||

| (1) | On September 2, 2016, Mr. Yongke Xue resigned from his position as the Chief Executive Officer of the Company and Chairman of the Board of the Directors of the Company. Mr. Yongke Xue was appointed Chief Executive Officer |

| (2) | |

| (3) | Member of the |

| (4) | ||

| (5) | Fuyou Li was appointed a member of the | |

| (6) | Yiliang Li was appointed a member of |

Yongke Xue, Chairman of the Board of DirectorsDirector and Chief Executive Officer

Mr. Yongke Xue was reappointedhas served as our Chairman and Chief Executive Officer effectivesince January 31, 2018. Mr. Xue previouslyalso served as our Chief Executive Officerin that position from February 26, 2008 to February 18, 2013, and from December 24, 2014 to September 2, 2016. Mr. Yongke Xue also serves as the Chairman of the Board. Mr. Yongke Xue has served as the director of SkyPeople (China) since December 2005. Mr. Xue served as the general manager of Hede from December 2005 to June 2007. Prior to that, he served as the business director of the investment banking division of Hualong Securities Co., Ltd. from April 2001 to December 2005. He also acted as the vice general manager of Shaanxi Huaye Foods Co., Ltd. from July 1998 to March 2001. Mr. Xue graduated from Xi’an Jiaotong University with an MBA in 2000. Mr. Xue graduated with a Bachelor’s degree in Metal Material & Heat Treatment from National University of Defense Technology in July 1989. The Board believes that Mr. Xue’s vision, leadership and extensive knowledge of the Company is essential to the development of its strategic vision.

Zhi Yan, Director

Mr. Yan has has served as the Company’s CTO since February 2018, and was appointed as a director on October 10, 2018. Since September 2017, Mr. Yan has also served as the director of Nova Realm Limited, in which the Company has a 5% equity interest. From August 2013 to July 2016, Mr. Yan served as a partner of Li’an (Beijing) Science and Technology Ltd., and from March 2010 to August 2013, he established and operated Weiwang Science and Technology Ltd. to develop an interactive reading system that makes long literary pieces easier to read. Mr. Yan has a degree in Aircraft Design and Fluid Mechanics from Beijing University of Aeronautics and Astronautics. The Board believes that Mr. Yan’s experience in blockchain technologies, cryptocurrenciesextensive knowledge of business and scientific and technologicaltechnology is essential to the development projects will benefit the Company’s new and developing lines of business.

Yiliang Li

Mr. Li has served as the Chairman of Dagong (Beijing) International Fund Management Co., Ltd. (“Dagong Beijing”) since October, 2015. From January, 2013 to October, 2015, Mr. Li was the head of the preparation committee for the establishment of Dagong Beijing. Mr. Li has also served as the Chairman of China Consumer Economy Association since December, 2017. Mr. Li received his Bachelor Degree of Engineering from Shandong University of Technology in 1982 and his Master Degree of Political Economics in 1995. The Board believes that Mr. Li’s significant business experience and connections to investment funds will be an asset to the Company and the Board.Company.

Fuyou Li

On May 8, 2015, the Company’s Board of Directors appointed Mr. Fuyou Li as a member of the Company’s Board of Directors effective as of that date. The Board of Directors also appointed Mr. Li as a member of both audit committee and compensation committee. Mr. Li graduated from Xi’an Jiaotong University with a doctor’s degree in economics. He has taught international finance as a professor in Xi’an Jiaotong University for the past 7 years. In determining that Mr. Li should serve on the Company’s Board of Directors, the Board considered, among other qualifications, his professional background and expertise in international finance.

Johnson Lau,Director

On December 23, 2014, the Board appointed Johnson Lau as a member of the Board of Directors of the Company and also the Chairman of Audit committee.committee and Compensation Committee.

Mr. Lau is the Chief Financial Officer of China Golden Classic GroupDafy Holdings Limited, (“China Golden”), a company listed in Hong Kong Stock Exchange Limited (HKEX: 8281.HK).1826.HK) since August 2018. Mr. Lau is a Certified Public Accountant of the Hong Kong Institute of Certified Public Accountants and CPA Australia. Mr. Lau has over 20 years of experience in the accounting profession. Mr. Lau started his career in Deloitte in Hong Kong and Beijing from 1997 to 2004. Prior to joining China GoldenDafy Holdings Limited in July 2015,2018, Mr. Lau worked in various public companies in the United States and England as Director of Finance and CFO for over ten years. He holds a bachelor degree in commerce from Monash University, Australia. The Board believes that Mr. Lau’s extensive knowledge and experience in accounting and his public company experience is important to the Company’s internal controls and financial reporting and its status as a US traded public company. During the period between 2004 and 2013, Mr. Lau worked in various public companies listed in the United States, England and Hong Kong as director of finance and chief financial officer. Mr. Lau was the chief financial officer and was subsequently an executive director of Haike Chemical Group Limited, a company listed on the London Stock Exchange (LSE code: HAIK), from December 2006 to March 2009. Mr. Lau subsequently resigned as chief financial officer and was redesignated as a non-executive director of Haike Chemical Group Limited in March 2009. He retired as a non-executive director in January 2010. From April 2009, Mr. Lau was employed by Auto China International Limited, a company listed on the NASDAQ Capital Market and subsequently quoted on the OTC Bulletin Board (NASDAQ/OTC code: AUTCF) as chief financial officer. He was redesignated as the director of finance in July 2009 and subsequently departed in June 2013. From June 2010 to January 2013, Mr. Lau was an independent director of Lizhan Environmental Corporation (NASDAQ code: LZEN). Mr. Lau was the chief financial officer of SGOCO Group, Ltd. (NASDAQ code: SGOC), from July 2013 to June 2015. Mr. Lau was the chief financial officer of China Golden Classic Group Limited (HKEX: 8281.HK) from July 2015 to July 2018. He was an independent non-executive director of Winshine Science Company Limited (HKEX: 209.HK) from October 2017 to April 2019. The Board believes that Mr. Lau’s qualifications and strong experience stated above is sufficient and helpful to our Company’s future development.

Fuyou Li,Director

On May 8, 2015, the Company’s Board of Directors appointed Mr. Fuyou Li as a member of the Company’s Board of Directors. The Board of Directors also appointed Mr. Li as a member of both the audit and compensation committees of the Board. Mr. Li graduated from Xi’an Jiaotong University with a doctor’s degree in economics. He has taught international finance as a professor at Xi’an Jiaotong University since 2000. In determining that Mr. Li should serve on the Company’s Board of Directors, the Board considered, among other qualifications, his professional background and expertise in international finance.

Yiliang Li, Director

Mr. Li was appointed as a member of the Board on May 6, 2018, and has served as the Chairman of Dagong (Beijing) International Fund Management Co., Ltd. (“Dagong Beijing”) since October 2015. From January 2013 to October 2015, Mr. Li was the head of the preparation committee for the establishment of Dagong Beijing, which engages in non-security business investment management and consultation; stock investment management; enterprise management consultation; and asset management. Mr. Li has also served as the Chairman of the China Consumer Economy Association since December 2017. Mr. Li received his Bachelor Degree of Engineering from Shandong University of Technology in 1982 and his Master’s Degree of Political Economics in 1995. The Board believes that Mr. Li’s experience and extensive knowledge is essential to the development of the Company.

CORPORATE GOVERNANCE

Pursuant to the Company’s Bylaws and the Florida Business Corporation Act, the Company’s business and affairs are managed under the direction of the Board. Directors are kept informed on the Company’s business through discussions with management, including the Chief Executive Officer and other senior officers, by reviewing materials provided to them and by participating in meetings.

Our Board meets on a regular basis during the year to review significant developments affecting us and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between scheduled meetings. Members of senior management regularly attend Board meetings to report on and discuss their respective areas of responsibility. The Board held 29twelve regularly scheduled and special meetings during fiscal year 2017.2018. All of the directors attended (in person or by telephone) 25all of the Board meetings and all directors attended any meetings of committees of the Board on which they served during the fiscal year. Directors are expected to use their best efforts to be present at the shareholders annual meeting. All of our directors attended the December 28, 20176, 2018 shareholders annual meeting.

Independent Directors

The Company’s Common Stock is listed on the NASDAQ GlobalCapital Market. NASDAQ requires that a majority of the Company’s directors be “independent,” as defined by the NASDAQ’s rules. Generally, a director does not qualify as an independent director if the director (or, in some cases, a member of the director’s immediate family) has, or in the past three years had, certain relationships or affiliations with the Company, its external or internal auditors, or other companies that do business with the Company. The Board of Directors has determined that a majority of the Company’s directors are independent directors under the NASDAQ rules. The Company’s independent directors are: Yiliang Li, Johnson Lau, Fuyou Li and FuyouYiliang Li.

Our Board of Directors, which is elected by our shareholders, is our ultimate decision-making body, except with respect to those matters reserved to our shareholders. The Board selects the officers who are charged with the conduct of our business, and has responsibility for establishing broad corporate policies and for our overall performance. The Board is not involved in operating details on a day-to-day basis. The Board is advised of our business through regular reports and analyses and discussions with our principal executive officer and other officers.

Code of Ethics and Governance Program

We have adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Our code of business conduct and ethics is available on our website at www.ftft.top and may be found by first clicking on “Investors,” then “Corporate Governance” and then “Governance Documents.” We intend to disclose any amendments to the code, or any waivers of its requirements, on our website.

Committees of the Board and Attendance at Meetings

The Board held 29twelve regularly scheduled and special meetings during fiscal year 2017.2018. All of the directors attended (in person or by telephone) 25all of the Board meetings and all directors attended any meetings of committees of the Board on which they served during the fiscal year. Directors are expected to use their best efforts to be present at the shareholders annual meeting. All of our directors attended the December 28, 20176, 2018 shareholders annual meeting.

Audit Committee and Report of the Audit Committee

On April 25, 2008, the Board formed an audit committee. Messrs. Johnson Lau, Yiliang Li and Fuyou Li currently serve on the audit committee, which is chaired by Mr. Lau. Each member of the audit committee is “independent” as that term is defined in the rules of the SEC and within the meaning of such term as defined under the rules of the NASDAQ GlobalCapital Market. The Board has determined that each audit committee member has sufficient knowledge in financial and auditing matters to serve on the audit committee. The audit committee held ninefour meetings during fiscal year 2017.2018, and all audit committee members attended each of those meetings. Our Board has determined that Mr. Lau is an “audit committee financial expert,” as defined under the applicable SEC rules. The audit committee has a written charter, which is available on the Company’s website at http://www.ftft.top.

Management is responsible for the Company’s internal controls and the financial reporting process. The independent accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”) and issuing reports thereon. The audit committee’s responsibility is to monitor these processes. The audit committee meets with management, the leader of the internal audit function, and the independent accounting firm to facilitate communication. In addition, the audit committee appoints the Company’s independent accounting firm and pre-approves all audit and non-audit services to be performed by the independent accounting firm.

In this context, the audit committee has discussed with the Company’s independent accounting firm the overall scope and plans for the independent audit. The audit committee reviewed and discussed the audited financial statements with management. Management represented to the audit committee that the Company’s consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Discussions about the Company’s audited financial statements included the independent accounting firm’s judgments about the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements. The audit committee also discussed with the independent accounting firm the other matters required to be discussed by PCAOB Auditing Standard No. 16 (Communications with Audit Committees). The Company’s independent accounting firm provided to the audit committee the written disclosures and the letter required by the PCAOB, and the committee discussed the independent accounting firm’s independence with management and the independent accounting firm.

Based on: (i) the audit committee’s discussion with management and the independent accounting firm; (ii) the audit committee’s review of the representations of management; and (iii) the report of the independent accounting firm to the audit committee, the audit committee recommended to the Board that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 20172018 filed with the SEC.

Compensation Committee

On April 25, 2008, the Board formed a compensation committee. Messrs. Johnson Lau, Yiliang Li and Fuyou Li currently serve on the compensation committee, which is chaired by Mr. Lau. Each member of the compensation committee is “independent” as that term is defined in the SEC rules and within the meaning of such term as defined under the rules of the NASDAQ GlobalCapital Market, a “nonemployee director” for purposes of Section 16 of the Exchange Act and an “outside director” for purposes of Section 162(m) of the Tax Reform ActInternal Revenue Code of 1986, as amended. No interlocking relationship exists between the Board or the compensation committee and the Board or compensation committee of any other company, nor has any interlocking relationship existed during the last fiscal year. The compensation committee held two meetingthree meetings during fiscal year 2017. All of the members of the2018, and all compensation committee members attended that meeting.those meetings. The compensation committee has a written charter, which is available on the Company’s website at http://www.ftft.top/.

Our Board has delegated to the compensation committee the responsibility, among other things, to determine any and all compensation payable to our executive officers, including annual salaries, incentive compensation, long-term incentive compensation and any other compensation, and to administer our equity and incentive compensation plans applicable to our executive officers. Decisions regarding executive compensation made by the compensation committee are considered final and are not generally subject to Board review or ratification. Under the terms of its written charter, the compensation committee has the power and authority to delegate any of its duties and responsibilities to subcommittees as the compensation committee may deem appropriate in its sole discretion. Historically, the compensation committee has not generally delegated any of its duties and responsibilities to subcommittees, but rather has taken such actions as a committee, as a whole. Deliberations and decisions by the compensation committee concerning executive officers are made by the compensation committee, without the presence of the any executive officer of the Company.

Other Committees

The Board may on occasion establish other committees, as it deems necessary or required. We do not currently have a standing nominating committee, or a committee performing similar functions. The independent directors of ourfull Board currently serveserves this function. Our directors believe that it is not necessary to have such committees, at this time, because the functions of such committees can be adequately performed by the Board. The Board will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment. There have been no material changes to the procedures by which security holders may recommend nominees to the Board.

8

Board Leadership Structure

Our Board of Directors is currently comprised of five members, including three independent directors who serve as members of our audit committee and compensation committee. Our Board leadership structure consists of a Chairman of the Board, who is also our CEO. Specifically, our Board of Directors is led by Mr. Yongke Xue, who has been serving as the Chairman of the Board since January 2018. Also, in his capacity as our Chief Executive Officer, Mr. Yongke Xue is able to draw on his intimate knowledge of the daily operations of the Company and its relationships with customers and employees. Calling upon this knowledge, Mr. Yongke Xue is able to utilize the in-depth focus and perspective gained in running the company to effectively and efficiently serve on our Board.

Board independence and oversight of the senior management of the Company are enabled by the presence of independent directors who have a wide range of expertise and skills and have oversight over critical functions of the Company, such as the review of business development, evaluation and compensation of executive management, the nomination of directors. We do not have a lead independent director. Our independent directors collectively provide additional strength and balance to our Board leadership structure.

Risk Management

The Chief Executive Officer and senior management are primarily responsible for identifying and managing the risks facing the Company under the oversight and supervision of the Board. The Chief Executive Officer reports to the Board of Directors regarding any risks identified and steps it is taking to manage those risks. In addition, the Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk in the areas of financial reporting and internal controls. The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to risk in the area of compensation policies and practices. Other general business risks such as economic, regulatory and permitting are monitored by the full Board.

Communications with Directors

Shareholders may communicate with the Board or to one or more individual members of the Board by writing Future FinTech Group Inc., 23F, China Development Bank Tower, No. 2,No.2, Gaoxin 1st Road, Xi’an, Shaanxi, China, 710075, Attention: Corporate Secretary. As appropriate, communications received from shareholders are forwarded directly to the Board, or to any individual member or members, depending on the facts and circumstances outlined in the communication. The Board has authorized the Secretary, in her discretion, to exclude communications that are patently unrelated to the duties and responsibilities of the Board, such as spam, junk mail and mass mailings. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded, with the provision that any communication that is filtered out by the Secretary pursuant to the policy will be made available to any non-management director upon request. Individual directors are not permitted to communicate with shareholders or others outside the Company unless they are deemed authorized persons under the Company’s corporate disclosure policy.

Compensation Committee Interlocks and Insider Participation

None of the Company’s executive officers has served as a member of a compensation committee, or other committee serving an equivalent function, of any other entity whose executive officers serve as a director of the Company or member of the Company’s compensation committee.

Family Relationships

Mr. Yongke Xue, our chairman of the board of directors and chief executive officer, is the brother of Mr. Hongke Xue, a former director of the Company, who resigned in August 2018. There are no other family relationships between any current executive officer or director of the Company.

Executive Officers

The following table sets forth as of October 11, 2018,10, 2019, the names, positions and ages of our current executive officers. Our officers are elected by the Board of Directors and their terms of office are, except to the extent governed by an employment contract, at the discretion of the Board of Directors.

| Name | Age | Principal Occupation | ||

| Yongke Xue (1) | Chairman of the Board & Chief Executive Officer | |||

| Zhi Yan (3) | 43 | Director, Chief Technical Officer | ||

| Kai Xu (4) | 36 | Chief Operating Officer |

| (1) | On September 2, 2016, |

| (2) | ||

| (3) | Zhi Yan was appointed as Chief Technology Officer on February 9, 2018 and member of the Board of Directors of the Company on October 10, 2018. | |

| (4) | Kai Xu was appointed as the Chief Operating Officer of the Company on February 28, 2019. |

Yongke Xue, Chairman of the Board & Chief Executive Officer

Mr. Yongke Xue’s biography is set forth above under the Section entitled “Board of Directors.”

Hanjun ZhengJing Chen, Chief Financial Officer

Mr. Hanjun Zheng was appointed byOn May 21, 2019, the Board as Interim Chief Financial Officer on November 27, 2015. Since December, 2009, Mr. Zheng has been servingof the Directors appointed Ms. Jing(Veronica) Chen as the Chief Financial Officer of SkyPeople Juice Group Co., Ltd. a company organized under the laws of China and a 73.42% indirectly-owned subsidiary(“CFO”) of the Company. Mr. Zheng was

Ms. Chen, age 53, served as the deputy general manager at Jingyang BranchCFO of SkyPeople Juice GroupAnZhiXinCheng (Beijing) Technology Co., Ltd. from March, 2006August 2018 to November 2009.May 2019. Ms. Chen has served as Independent Director of Hello iPayNow (Beijing) Company Ltd. since April 2019. From August 2017 to July 2018, Ms. Chen served as CFO of Beijing Logis Technology Development Co., Ltd., a company listed on The National Equities Exchange and Quotations Co., Ltd. of China which is a Chinese over-the-counter stock trading system. From June 2016 to July 2017, Ms. Chen served as Group Chief Financial Officer of Beijing AnWuYou Food Co., Ltd. Ms. Chen served as Chief Financial Officer Beijing DKI Investment Management Co., Ltd. from August 2012 to May 1994 to February, 2006, Mr. Zheng was the Financial Accounting Manager at Shaanxi Provincial Fruit Juice Processing Factory,2016. Ms. Chen received a state-owned enterprise in Shaanxi, China. Mr. Zheng earned his bachelor degree in accounting by passing Chinese National Self-Examination in Financial Accounting in 1996. Mr. Zheng graduatedof Doctor of Business Administration from Shaanxi Technical College of Finance and Economics and received his junior college degree in Financial Accounting in 1994. Mr. Zheng received additional training in Advanced Business Management and Advanced Financial and Accounting Management at JiaotongVictoria University, Neuchatel, Switzerland in March 20112008 and July, 2012, respectively. There is no family relationship between Mr. Zheng and anyan MBA degree from City University of Seattle, Washington, U.S. in April, 2000. Ms. Chen holds Fellow Membership of CPA Australia (FCPA), Fellow Membership of the Company’s directorsAssociation of International Accountants U.K. (FAIA). Ms. Chen is a Member of the Chartered Institute of Management Accountants (CIMA), a Senior Member of the International Financial Management (SIFM) accredited by the Ministry of Human Resources and officers. The Board believes that Mr. Zheng’s strong experience in accountingSocial Security of PRC and financial reporting is important toa Certified Internal Control Professional, as granted by Internal Control Institute (ICI). In connection with her appointment as CFO, the Company sinceentered into an employment agreement (the “Agreement”) with Ms. Chen on May 21, 2019.

Zhi Yan, Director and Chief Technical Officer

Mr. Zhi Yan’s biography is set forth above under the Company is listed in the United States. Section entitled “Board of Directors.”

10

Kai Xu, Chief Operating Officer

On February 28, 2019, the board of directors appointed Mr. Kai Xu as the Chief Operating Officer (“COO”) of the Company.

Kai Xu, age 36, has served as COO of the Company’s wholly owned subsidiary, Chain Future Digital Tech (Beijing) Ltd since July 2018. From February 2015 to April 2018, Mr. Xu served as COO and partner of Beijing Yongle Shengshi Science Ltd. From November 2009 to February 2015, Mr. Xu worked for Beijing Zhongxun Yonglian Science and Technology Ltd. as the director of operations, responsibile for online game operation and promotion. Mr. Xu received his bachelor degree in Computer Networks from the Party School of Beijing Civil Affairs Bureau in 2006.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act, requires that directors, certain officers of the Company and more than ten percent shareholders file reports of ownership and changes in ownership with the Commission as to the Company’s securities beneficially owned by them. Such persons are also required by SEC rules to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of copies of such forms received by the Company, or on written representations from certain reporting persons, the Company believes that all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent shareholders were complied with during the fiscal year ended December 31, 2017,2018, except for the following: Yongke Xue and Zeyao Xue did not file Form 4s for the transactions reported by them in that Amendments No. 7 and No. 6 to Schedule 13D filed by them on June 4, 2018 and April 26, 2018, respectively, Shuiliang Xiao did not file a Form 3 and Form 4 for the transactions reported by him in that Amendment No. 3 to Schedule 13D13G filed by Mr. XueXiao on June 28, 2017; and Yongke Xue and Zeyao XueMay 2, 2018, Mengyao Chen did not file Formsa Form 3 and Form 4 (and in the case of Zeyao Xue, Form 3) for the transactions reported by themher in that Amendment No. 5 to Schedule 13D13G filed by themMs. Chen on October 6, 2017.May 2, 2018.

Involvement in Certain Legal Proceedings

None of our directors or executive officers has, during the past ten years:

| Ø | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences); |

| Ø | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| Ø | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| Ø | been found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| Ø | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| Ø | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Review, Approval or Ratification of Transactions with Related Parties

On September 30, 2008, our Board of Directors approved a statement of policies and procedures with respect to related party transactions, which was amended on July 11, 2011. A copy of the amended and restated statement of policies and procedures is available on the Company’s website at http://www.ftft.top/.

The statement of policies and procedures with respect to related party transactions, as amended, requires the audit committee to review the material facts of all interested transactions, as further described below, unless an exception applies, and either approve or disapprove of our entry into an interested transaction. If the audit committee’s advance approval of an interested transaction is not feasible, then such interested transaction shall be considered at the audit committee’s next regularly scheduled meeting and, if the audit committee determines it to be appropriate, then such interested transaction shall be ratified.

In determining whether to approve or ratify an interested transaction, the audit committee will take into account, among other factors it deems appropriate, whether the interested transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related party’s interest in the transaction, as described below. Pursuant to the statement of policies and procedures with respect to related party transactions, no director shall participate in any discussion or approval of an interested transaction for which he or she is a related party, except that such director shall provide all material information concerning the interested transaction to the audit committee. If an interested transaction is ongoing, the audit committee may establish guidelines for our management to follow in our ongoing dealings with the related party. Thereafter, the audit committee, on at least an annual basis, shall review and assess ongoing relationships with the related party to see that such related party is in compliance with the audit committee’s guidelines and that the interested transaction remains appropriate.

For purposes of the statement of policies and procedures with respect to related party transactions:

| ● | an “interested transaction” is a transaction required to be disclosed pursuant to Item 404 of Regulation S-K promulgated under the Securities and Exchange Act of 1934, as amended, and |

| ● | a “related party” has the meaning ascribed to the term “related person” under Item 404 of Regulation S-K promulgated under the Securities and Exchange Act of 1934, as amended. |

Notwithstanding the foregoing, each of the following interested transactions shall be deemed to be pre-approved by the audit committee, even if the aggregate amount involved exceeds $50,000:

| ● | Employment of executive officers. Any employment of an executive officer if either (i) the related compensation is required to be reported in our proxy statement under Item 402 of the Commission’s compensation disclosure requirements generally applicable to “named executive officers” or (ii) the executive officer is not an immediate family member of another executive officer or director, the related compensation would be reported in our proxy statement under Item 402 of the Commission’s compensation disclosure requirements if the executive officer was a “named executive officer” and our compensation committee approved or recommended that the board of directors approve such compensation. |

| ● | Director compensation. Any compensation paid to a director if the compensation is required to be reported in our proxy statement under Item 402 of the Commission’s compensation disclosure requirements. |

| ● | Certain transactions with other companies. Any transaction with another company at which a related party’s only relationship is as an employee other than an executive officer, director or beneficial owner of less than 10% of that company’s shares, if the aggregate amount involved does not exceed 2% of that company’s total annual revenue. |

| ● | Certain charitable contributions. Any charitable contribution, grant or endowment by us to a charitable organization, foundation or university at which a related party’s only relationship is as an employee other than an executive officer or a director, if the aggregate amount involved does not exceed the lesser of $50,000 or 2% of the charitable organization’s total annual receipts. |

| ● | Transactions where all shareholders receive proportional benefits. Any transaction where the related party’s interest arises solely from the ownership of our Common Stock and all holders of our Common Stock received the same benefit on a pro rata basis, such as dividends. |

| ● | Transactions involving competitive bids. Any transaction involving a related party where the rates or charges involved are determined by competitive bids. |

| ● | Regulated transactions. Any transaction with a related party involving the rendering of services as a common or contract carrier or public utility, at rates or charges fixed in conformity with law or governmental authority. |

| ● | Certain banking-related services. Any transaction with a related party involving services as a bank depositary of funds, transfer agent, registrar, trustee under a trust indenture or similar services. |

Related Party Transactions since January 1, 20172018

Sales

The company’s subsidiary sold fruit beverages to a related entity, Shaanxi Fullmart Convenient Chain Supermarket Co., Ltd. (“Fullmart”) for approximately $62,000$8,810 and $360,184$62,000 for the year ended December 31, 20172018 and 2016,2017, respectively. The sales to this related party were consistent with pricing and terms offered to third parties. The remained accounts receivable balances were $0and$0 and $308,304 as of December 31, 20172018 and 2016,2017, respectively. Fullmart is a company indirectly owned by a member of our Board of Directors,Chairman and CEO, Mr. Yongke Xue.

Long-term loan – related party

There were no short-term loans to a related party as of December 31, 2017.

On February 18, 2013, SkyPeople (China) entered into a loan agreement with SkyPeople International Holdings Group Limited (the “Lender”). The Lender indirectly holds 50.2% interest in the Company at the time of the loan agreement. Mr. Yongke Xue (“Y. K. Xue”), then the Chairman and Chief Executive Officer (“CEO”) of the Company and currently a Member of the Company’s Board of Directors (the “Board”) and Mr. Hongke Xue, our Chairman and CEO, indirectly and beneficially own 80.0% and 9.4% of the equity interest in the Lender, respectively. Pursuant to the Agreement, the Lender agreed to extend to the Company a one-year unsecured term loan with a principal amount of $8.0 million at an interest rate of 6% per annum. During 2013, the Company received $8.0 million from the Lender. In February 2014, both parties extended this loan for another two years under the original terms of the agreement.

On October 16, 2015, the Company entered into a Share Purchase Agreement with the Lender to sell 5,321,600 shares of the common stock of the Company (pre-Reverse Split Stock) at the price of $7,982,400, and which was paid by cancellation of the loan by the Lender. On March 10, 2016, the Lender canceled the loan and the shares were issued to the Lender.

SECURITY OWNERSHIP OF DIRECTORS, OFFICERS AND CERTAIN BENEFICIAL OWNERS OF FUTURE FINTECH GROUP INC.

The following table sets forth information concerning beneficial ownership of our Common Stock as of October 12, 201810, 2019 by:

| ● | each shareholder or group of affiliated shareholders who owns more than 5% of our Common Stock; |

| ● | each of our named executive officers; |

| ● | each of our directors; and |

| ● | all of our directors and executive officers as a group. |

The following table lists the number of shares and percentage of shares beneficially owned based on 26,017,08332,317,083 shares of our Common Stock outstanding as of October 12, 2018.10, 2019.

Beneficial ownership is determined in accordance with the SEC rules, and generally includes voting power and/or investment power with respect to the securities held. Shares of Common Stock subject to options and warrants currently exercisable or exercisable within 60 days of October 12, 201810, 2019 or issuable upon conversion of convertible securities which are currently convertible or convertible within 60 days of October 12, 201810, 2019 are deemed outstanding and beneficially owned by the person holding those options, warrants or convertible securities for purposes of computing the number of shares and percentage of shares beneficially owned by that person, but are not deemed outstanding for purposes of computing the percentage beneficially owned by any other person. Except as indicated in the footnotes to this table, and subject to applicable community property laws, the persons or entities named have sole voting and investment power with respect to all shares of our Common Stock shown as beneficially owned by them.

Unless otherwise indicated in the footnotes, the principal address of each of the shareholders, named executive officers, and directors below is c/o Future FinTech Group Inc., 23F, China Development Bank Tower, No. 2 Gaoxin 1st Road, Xi’an, Shaanxi Province, PRC 710075.

| Shares Beneficially Owned | Shares Beneficially Owned | Shares Beneficially Owned | ||||||||||||||

| Name of Beneficial Owner | Number | Percent | Number | Percent | ||||||||||||

| Directors, Named Executive Officers and 5% Shareholders | ||||||||||||||||

| Yongke Xue (1) | 1,671,955 | 6.4 | % | 1,671,955 | 5.17 | % | ||||||||||

| Yiliang Li | — | |||||||||||||||

| Zhi Yan | — | — | 50,000 | 0.15 | % | |||||||||||

| Yiliang Li | — | — | ||||||||||||||

| Hanjun Zheng | — | — | — | |||||||||||||

| Fuyou Li | — | — | — | — | ||||||||||||

| Johnson Lau | — | — | — | — | ||||||||||||

| All current directors and executive officers as a group (6 persons) | 1,671,955 | 6.4 | % | 1,721,955 | 5.33 | % | ||||||||||

| Zeyao Xue (2) | 13,034,114 | 50.0 | % | 13,084,114 | 40.49 | % | ||||||||||

| Sincerity Group Enterprises (5) | 5,000,000 | 15.47 | % | |||||||||||||

| Mengyao Chen (3) | 3,323,225 | 12.77 | % | 3,323,225 | 10.28 | % | ||||||||||

| Shuiliang Xiao (4) | 3,409,466 | 13.11 | % | 3,409,466 | 10.55 | % | ||||||||||

| 19,766,805 | 75.98 | % | 24,816,805 | 76.79 | % | |||||||||||

| (1) | Consists of (i) 1,488,570 shares owned directly by Golden Dawn International Limited, a British Virgin Islands company, and (ii) 183,385 shares owned directly by China Tianren Organic Food Holding. Each of SP International, Golden Dawn International Limited and China Tianren Organic Good Holding are indirect subsidiaries of V.X. Fortune Capital Limited, a British Virgin Islands company. Yongke Xue is the sole director of V.X. Fortune Capital Limited. |

| (2) | Mr. Zeyao Xue, the son of Yongke Xue, holds all of the issued and outstanding capital stock of Fancylight Limited, which is the indirect owner of those shares held by SP International, Golden Dawn International Limited and China Tianren Organic Food Holding. As such, Mr. Zeyao Xue shares beneficial ownership of |

| (3) | The shares were issued to Mengyao Chen, pursuant to a Creditor’s Rights Transfer Agreement between Hedetang Foods (China) Co., Ltd., a wholly owned subsidiary of the Company and Shaanxi Fu Chen Venture Capital Management Co., Ltd., dated November 2, 2017, which was filed with SEC in a Form 8-K dated November 6, 2017. |

| (4) | The shares were issued to Shuiliang Xiao, pursuant to two Creditor’s Rights Transfer Agreements between Hedetang Foods (China) Co., Ltd., a wholly owned subsidiary of the Company and Shaanxi Chunlv Ecological Agriculture Co., Ltd. and Hedetang Foods (China) Co., Ltd, dated November 2, 2017, which was filed with SEC in a Form 8-K dated November 6, 2017. |

| (5) | The shares were issued to Lake Chenliu, pursuant to a Share Transfer and Assets Investment Agreement between Digipay Fintech Limited (“Digipay”), a limited liability company incorporated in the British Virgin Islands and a wholly-owned subsidiary of the Company, Lake Chenliu, an individual resident of Costa Rica, and InUnion Chain Ltd. (“InUnion”), a British Virgin Islands company wholly owned by Mr. Chenliu, dated June 22, 2018, which was filed with SEC in a Form 8-K on the same date. |

Equity Compensation Plan

The following table sets forth information as of December 31, 2017,2018, with respect to our equity compensation plans previously approved by shareholders and equity compensation plans not previously approved by shareholders.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information as of December 31, 2018, with respect to our equity compensation plans previously approved by stockholders and equity compensation plans not previously approved by stockholders.

| Equity Compensation Plan Information | ||||||||||||

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | I | ||||||||||

| Equity compensation plans approved by shareholders (1) | 62,500 | $ | 3.57 | (2) | -- | |||||||

| Equity compensation plans not approved by shareholders | N/A | $ | N/A | -- | ||||||||

| Total | N/A | $ | N/A | -- | ||||||||

| Equity Compensation Plan Information | ||||||||||||

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by stockholders (1) | 62,500 | $ | 3.57 | (2) | - | |||||||

| Equity compensation plans not approved by stockholders | $ | N/A | - | |||||||||

| Total | $ | N/A | ||||||||||

| (1) | Consists of equity incentive plans, which |

On March 29, 2017, the Company issued 250,000 shares of the Company’s unrestricted common stock to six of the Company’s employees pursuant to our 2015 Omnibus Equity Plan, which was approved by the Company’s shareholders at the annual On March 13, 2018, the Company’s shareholders approved the 2017 Omnibus Equity Plan at the annual shareholders meeting, which permits the grant of incentive stock options (“ISOs”), nonqualified stock options (“NQSOs”), stock appreciation rights (“SARs”), restricted stock, unrestricted stock and restricted stock units (“RSUs”) to its employees of up to 1,300,000 shares of Common Stock. On December 21, 2018, the Company granted 1,300,000 shares of the Company’s unrestricted common stock to seven of the Company’s employees pursuant to our 2017 Omnibus Equity Plan, which was approved by the Company’s shareholders at the annual shareholders meeting on December 6, 2018. The Company recorded an expense of $13,000 in the fourth quarter of fiscal year 2018 under the 2017 Omnibus Equity Plan, reflecting a par value of $0.001 per share of the Company’s common stock. | |

| (2) | The exercise price of options granted and stock appreciation rights under the Plan may be no less than the fair market value of the Company’s Stock on the date of grant. |

COMPENSATION

Summary Compensation of Named Executive Officers

Our executive officers do not receive any compensation for serving as executive officers of the Company. Our CFO isHowever, except for our former CEO, the remaining executive officers are compensated by and through SkyPeople (China). Our former CEO, Yongke Xue, has not received any compensation from us or any of our subsidiaries for his services in the past three years. The following table sets forth information concerning cash and non-cash compensation paid by the Company or SkyPeople (China) to our named executive officers for 2017 and 2016, respectively.2018.

| Name and Principal Position | Year Ended | Salary ($) | Bonus ($) | Stock Awards | Option Awards | Non-Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||

| Yongke Xue (1) | 12/31/2017 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||

| Yongke Xue (1) | 12/31/2016 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||

| Hongke Xue (1) | 12/31/2017 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||

| Hongke Xue (1) | 12/31/2016 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||

| Hanjun Zheng(2) | 12/31/2017 | $ | 12,863 | - | - | - | - | - | - | $ | 12,863 | |||||||||||||||||||||||

| 12/31/2016 | $ | 12,352 | - | - | - | - | - | - | $ | 12,352 | ||||||||||||||||||||||||

| Name and Principal Position | Year Ended | Salary ($) | Bonus ($) | Stock Awards | Option Awards | Non-Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||

| Yongke Xue (1) | 12/31/2018 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||

| - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Hanjun Zheng (2) | 12/31/2018 | $ | 12,863 | - | 300,000 | - | - | - | - | $ | 12,863 | |||||||||||||||||||||||

| 12/31/2017 | $ | 12,863 | - | - | - | - | - | - | $ | 12,863 | ||||||||||||||||||||||||

| (1) | |

| 2018. | |

| (2) | Mr. Hanjun Zheng was appointed by the Board as Interim Chief Financial Officer on November 27, |

Outstanding Equity Awards at December 31, 20172018

The following table presents certain information concerning outstanding equity awards held by each of our named executive officers at December 31, 2017.2018.

| Option Awards | ||||||||||||||||||||

| Name | Number of securities underlying unexercised options (#) exercisable | Number of securities underlying unexercised options (#) unexercisable | Equity incentive plan awards: number of securities underlying unexercised unearned options (#) | Option exercise price ($) | Option expiration date | |||||||||||||||

| Yongke Xue | - | - | - | - | ||||||||||||||||

| - | ||||||||||||||||||||

| Hanjun Zheng | - | - | - | - | - | |||||||||||||||

On February 28, 2017, the Company issued options to purchase 62,500 shares of the Company’s common stock with an exercise price equal to the fair market value of the Company’s Common Stock (as defined under the 2011 Stock Incentive Plan in conformity with Regulation 409A of the Internal Revenue Code of 1986, as amended) at the date of grant to three of the Company’s employees pursuant to the 2011 Stock Incentive Plan, which was approved by the Company’s shareholders at the annual shareholders meeting on August 18, 2011. These options vested immediately on the grant date with a fair market value of $223,375 based on the fair value of $3.57 per share, which was determined by using the Black Scholes option pricing model. The Company recognized stock-based compensation expense of $223,375 in the first quarter of fiscal year 2017 under the 2011 Stock Incentive Plan.

The Company’s 2015 Omnibus Equity Plan permits the grant of incentive stock options (“ISOs”), nonqualified stock options (“NQSOs”), stock appreciation rights (“SARs”), restricted stock, unrestricted stock and restricted stock units (“RSUs”) to its employees of up to 250,000 shares of Common Stock.

On March 13, 2018, the Company’s shareholders approved the 2017 Omnibus Equity Plan at the annual shareholders meeting, which permits the grant of incentive stock options (“ISOs”), nonqualified stock options (“NQSOs”), stock appreciation rights (“SARs”), restricted stock, unrestricted stock and restricted stock units (“RSUs”) to its employees of up to 1,300,000 shares of Common Stock.

On December 21, 2018, the Company granted 1,300,000 shares of the Company’s unrestricted common stock to seven of the Company’s employees pursuant to our 2017 Omnibus Equity Plan, which was approved by the Company’s shareholders at the annual shareholders meeting on December 6, 2018. The Company recorded an expense of $13,000 in the fourth quarter of fiscal year 2018 under the 2017 Omnibus Equity Plan, reflecting a par value of $0.001 per share of the Company’s common stock.

Compensation of Directors

We (i) pay each of our nonemployee directors residing outside the United States an annual fee of $8,850, (ii) reimburse our directors for actual, reasonable and customary expenses incurred in connection with the performance of their duties as board members and (iii) pay the chairman of our audit committee a fee of $25,000 for his or her service as chairman.

There was no change to the compensation to our directors in 2017. The following table sets forth information concerning cash and non-cash compensation paid by us to our directors during 2017.2018.

| Name | Fees Paid in Cash ($) | Stock Awards | Option Awards | Non-Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | Fees Paid in Cash ($) | Stock Awards | Option Awards | Non-Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||||||||||||||||||||

| Yongke Xue | — | — | — | — | — | — | — | $ | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Hongke Xue | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Guolin Wang (1) | $ | 8,850 | — | — | — | — | — | $ | 8,850 | |||||||||||||||||||||||||||||||||||||||||||||||

| Yiliang Li (1) | $ | 5,722 | — | — | — | — | — | $ | 5,722 | |||||||||||||||||||||||||||||||||||||||||||||||

| Fuyou Li (2) | $ | 8,850 | — | — | — | — | — | $ | 8,850 | $ | 8,850 | — | — | — | — | — | $ | 8,850 | ||||||||||||||||||||||||||||||||||||||

| Johnson Lau (3) | $ | 25,000 | — | — | — | — | — | $ | 25,000 | $ | 25,000 | — | — | — | — | — | $ | 25,000 | ||||||||||||||||||||||||||||||||||||||

| Zhi Yan (4) | $ | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Hongke Xue (5) | $ | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | On |

| Company. | |